This Week’s Top Economic Data and Events

Consumer Confidence

Scheduled: 01/31 • Estimate: 108.9 • Previous: 108.3 With Confidence expected only to notch upward slightly, even a flat reading may not put much downward pressure on mortgage rates.ISM Manufacturing Index

Scheduled: 02/01 • Estimate: 48.0 • Previous: 48.4 The slowing in manufacturing is starting to worry more experts, and a dip below 47.8 could create more downward pressure on mortgage rates.FOMC Policy Announcement

Scheduled: 02/01 If the Fed highlights that inflation is slowing, the economy is cooling, and only raises its rate a quarter point, rates could slide down slightly.Fed Chair Press Conference

Scheduled: 02/01 If Powell highlights that inflation is still twice the Fed’s target and not slowing at the rate the Fed wants, we could see rates moving upward.Nonfarm Payrolls

Scheduled: 02/03 • Estimate: 185K • Previous: 223K If the hot labor market manages to create over 210K jobs again, then mortgage rates will experience some growing upward pressure.Economic Snapshot

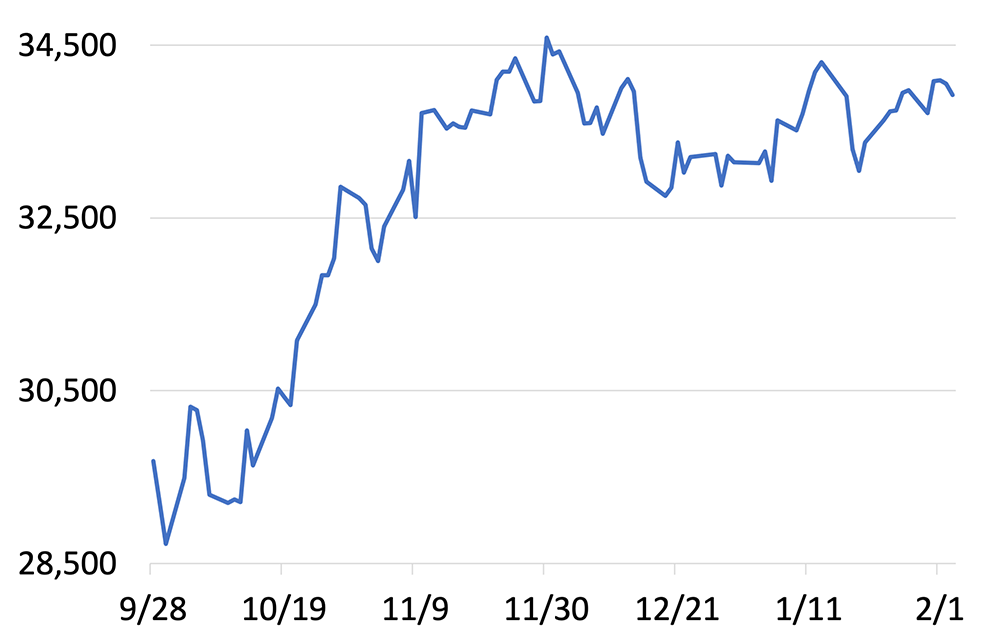

DOW Jones

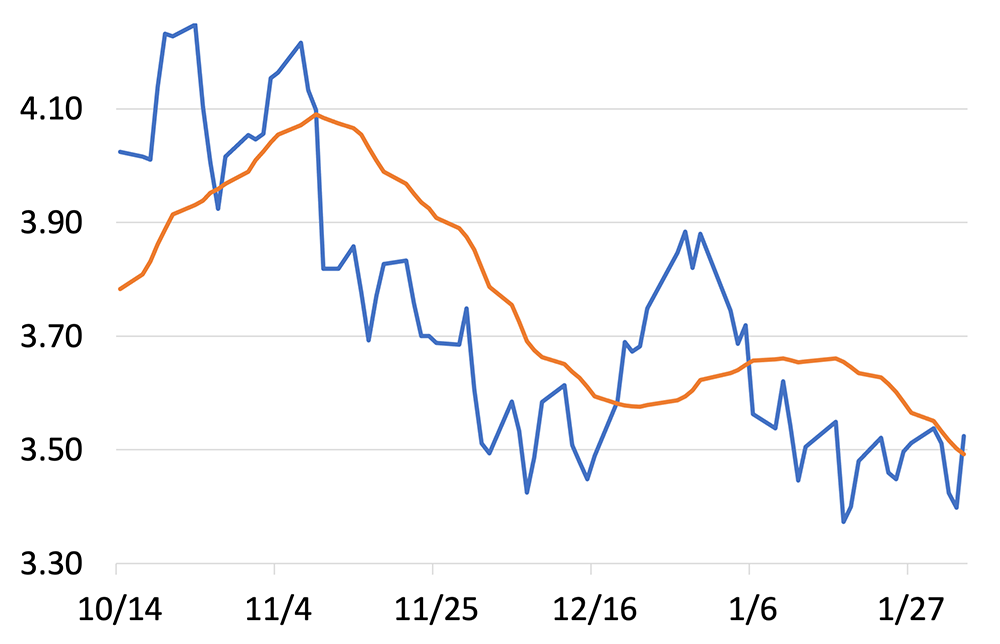

| 10-Year CMT with 20-Day Average

|

Gross Domestic Product | PCE Price Index (core) ▲ 0.2% Released: 12/23 • Previous 0.3% |

| Unemployment Rate ⬌ 3.7% Released: 12/02 • Previous 3.5% | Nonfarm Payrolls ▲ 263,000 Released: 11/30 • Previous 284,000 |